The Multi-Billion Dollar Crypto Market in China and Hong Kong: How Can Traditional Brokerages Get a Slice of the Pie?

As the cryptocurrency market rapidly evolves, China and Hong Kong have emerged as two of the most active trading regions globally. Recent data indicates that the combined cryptocurrency trading volume in these areas has reached over a trillion US dollars. This immense market naturally attracts significant attention, especially from traditional brokerage firms. So, how can they secure a share of this rapidly growing market

Overview of the Cryptocurrency Market in China and Hong Kong

Market Size and Growth

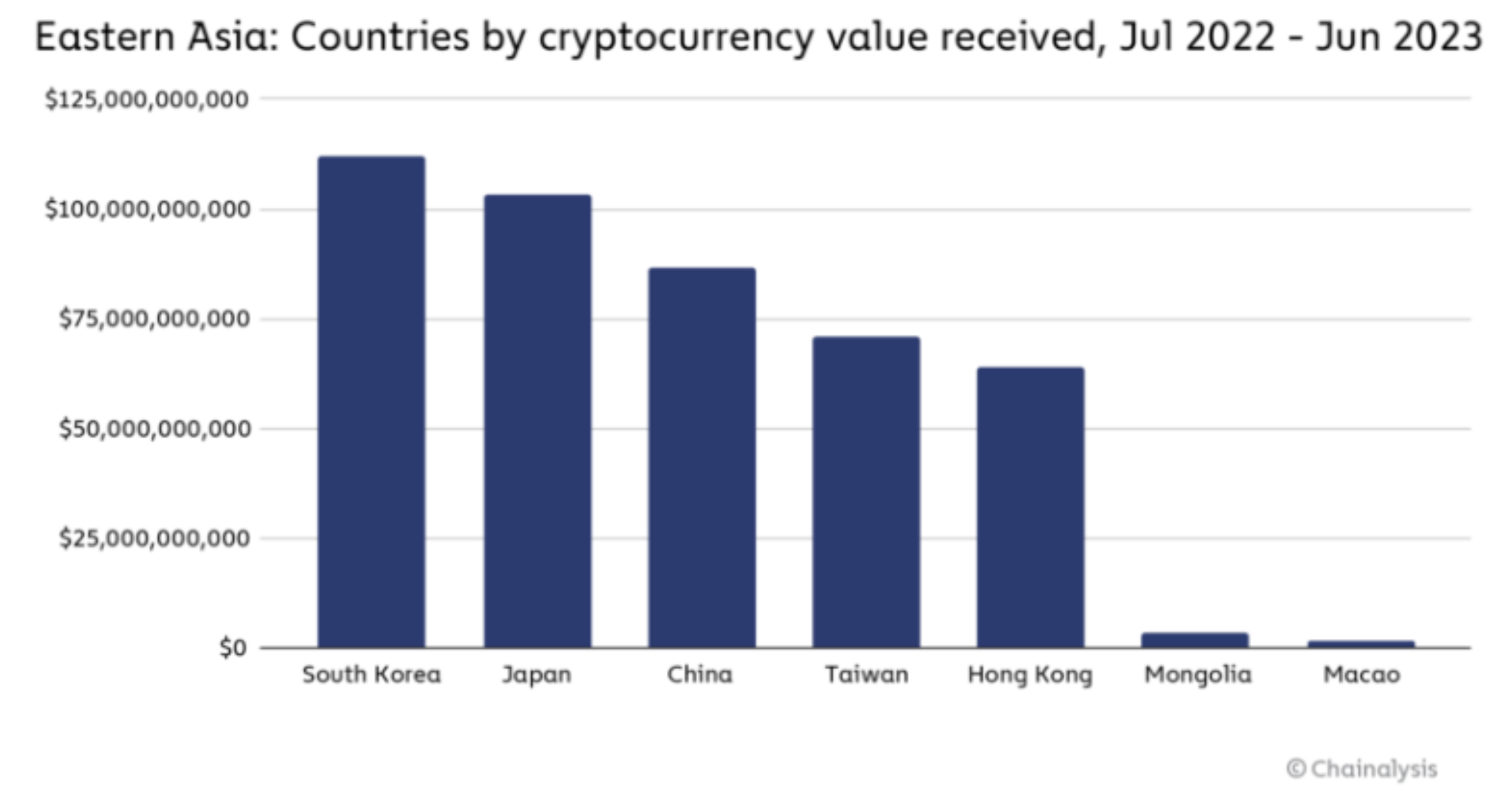

With global interest in cryptocurrencies rising, the cryptocurrency markets in China and Hong Kong have also expanded quickly. According to Chainalysis, the trading volume in these regions reached approximately 150 billion USD in 2023, accounting for about 10% of the global market. This growth rate demonstrates the enormous potential of cryptocurrencies in these regions.

China Market

China's cryptocurrency market has undergone several policy changes, but investor interest remains strong. Despite the government's efforts to curb illegal cryptocurrency activities, the market has continued to grow. In technologically advanced cities like Beijing, Shanghai, and Shenzhen, the adoption rate and trading volume of cryptocurrencies are rapidly increasing.

Hong Kong Market

Hong Kong, as a financial hub in Asia, boasts a vibrant cryptocurrency market. The city’s well-developed financial infrastructure and open market policies make it a crucial hub for cryptocurrency trading. Many internationally renowned cryptocurrency exchanges and blockchain companies have set up offices or headquarters in Hong Kong, further fueling market prosperity.

Characteristics of Investors

Tech-Savvy Younger Generation

The younger generation in China and Hong Kong has a strong interest in technology, particularly in blockchain and cryptocurrencies. They are open to new technologies and willing to try new things. Coupled with their high-risk tolerance, they form a significant force in the cryptocurrency market.

Professional Investment Institutions

Besides individual investors, professional investment institutions are also actively participating in the cryptocurrency markets of China and Hong Kong. These institutions, with their rich investment experience and capital strength, profit from the market through various investment strategies such as quantitative trading and arbitrage trading.

Large Number of Retail Investors

China and Hong Kong have a large number of retail investors who are eager for high-yield investment opportunities. The high volatility and potential high returns of the cryptocurrency market attract these investors, increasing market activity and trading volume.

Impact of Regulatory Policies

China’s Regulatory Dynamics

China’s stance on cryptocurrencies has undergone multiple changes. Initially, the government imposed strict restrictions on cryptocurrency trading and ICOs (initial coin offerings). However, with the development and application of blockchain technology, China has begun to explore and support its legal uses. In 2020, the People’s Bank of China launched a pilot program for the digital yuan, further promoting the development of digital currencies.

Hong Kong’s Regulatory Environment

Hong Kong adopts a relatively open attitude toward cryptocurrency regulation. The Hong Kong Securities and Futures Commission (SFC) has established a regulatory framework for cryptocurrency exchanges, requiring eligible exchanges to apply for licenses to ensure market compliance and security. These measures protect investors' interests and promote healthy market development.

Market Prospects

With continuous technological advancements and expanding application scenarios, the cryptocurrency markets in China and Hong Kong are set to grow. The extensive application of blockchain technology in finance, healthcare, logistics, and other fields will further drive market development. Additionally, as the regulatory environment gradually improves, the market will become more stable and transparent, attracting more investors.

Traditional brokerage firms have significant opportunities and potential in this market environment. By actively participating and strategically positioning themselves, they can reap substantial rewards from this trillion-dollar market.

Challenges and Opportunities for Traditional Brokerage Firms

Challenges

Regulatory Uncertainty: Despite the relaxed attitudes towards cryptocurrencies in China and Hong Kong, regulatory policies remain uncertain, requiring traditional brokerage firms to be cautious when entering the market.

Technical Barriers: Cryptocurrency trading platforms require high levels of technical support, posing a significant challenge for traditional brokerage firms. Building a secure and efficient trading platform is a critical issue they must address.

Intense Market Competition: The market is currently dominated by several professional cryptocurrency exchanges such as Binance and Huobi. To stand out among these strong competitors, traditional brokerage firms must possess unique competitive advantages.

Opportunities

Brand Trust: Compared to emerging cryptocurrency exchanges, traditional brokerage firms have higher brand trust and market reputation, helping them attract conservative investors interested in cryptocurrencies.

Rich Customer Resources: Traditional brokerage firms have a vast customer base, including many potential cryptocurrency investors. Leveraging existing customer resources, they can quickly open the market.

Comprehensive Service Advantage: Traditional brokerage firms can integrate cryptocurrency trading with other financial services to provide one-stop comprehensive financial services, an advantage that professional cryptocurrency exchanges find hard to match.

Entry Strategies for Traditional Brokerage Firms

Building a Professional Cryptocurrency Trading Platform

To succeed in the cryptocurrency market, traditional brokerage firms first need to establish a professional trading platform. This platform should have the following characteristics:

High Security: Security is paramount for cryptocurrency trading platforms. Traditional brokerage firms can utilize their years of accumulated technical experience in the financial industry to create a highly secure trading platform.

User-Friendly Operations: User experience is key to the success of a trading platform. Traditional brokerage firms should focus on the platform’s usability, providing a simple and intuitive interface for investors.

Diverse Trading Products: In addition to mainstream cryptocurrencies like Bitcoin and Ethereum, traditional brokerage firms can offer more trading products such as cryptocurrency futures and options to meet different investors' needs.

Strengthening Cooperation with the Cryptocurrency Sector

Traditional brokerage firms can quickly gain technical support and market resources by collaborating with professional companies in the cryptocurrency sector. For example, partnering with renowned cryptocurrency exchanges and blockchain technology companies to develop new trading products and services.

Providing Professional Investment Advice and Training

For investors unfamiliar with the cryptocurrency market, traditional brokerage firms can offer professional investment advice and training services. This not only helps investors better understand the cryptocurrency market but also boosts their investment confidence.

Strictly Adhering to Regulatory Policies

While regulatory uncertainty poses a challenge, it also presents an opportunity. By strictly adhering to regulatory policies, traditional brokerage firms can establish a good market image and gain investors' trust.

As the cryptocurrency markets in China and Hong Kong rapidly develop, traditional brokerage firms face unprecedented opportunities. Despite challenges such as regulatory policies, technical barriers, and market competition, traditional brokerage firms can leverage their brand trust, customer resources, and comprehensive service advantages to secure a share of this trillion-dollar market. For those traditional brokerage firms that have yet to enter the market, now is the best time to seize the opportunity and take swift action.

Want to be the first to capture market share? UD Blockchain provides one-stop technical and consulting solutions for your platform to offer cryptocurrency spot trading. Want to know how? Consult a blockchain expert now.